What Is Reconciliation Account in SAP? A Comprehensive Guide

Having spent over a decade implementing SAP financial modules for various companies, I've found that reconciliation accounts are often misunderstood yet absolutely critical for proper financial management.

Let me walk you through what they are and why they matter.

Understanding Reconciliation Accounts in SAP

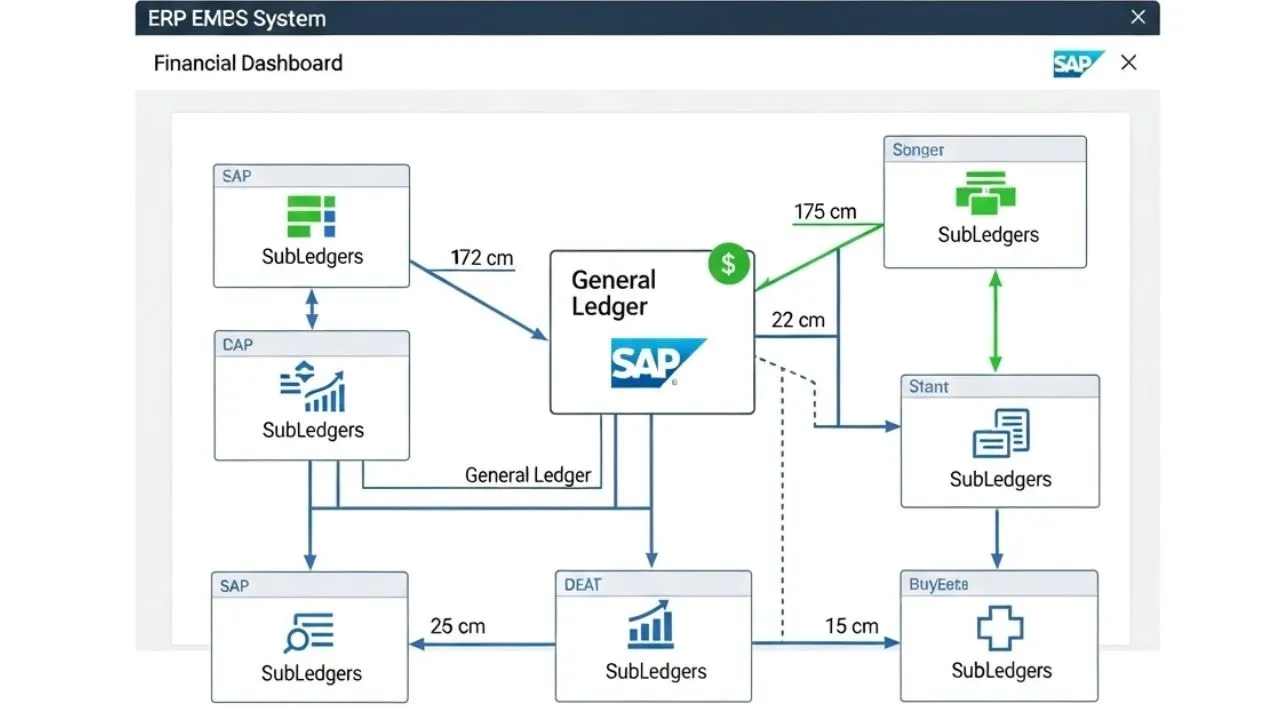

When I first started working with SAP, I struggled to grasp the concept of reconciliation accounts. Simply put, a reconciliation account in SAP is a balance sheet general ledger account that acts as a control account.

Think of it as the middleman between your detailed subledgers (like customer accounts or vendor accounts) and your general ledger.

.The beauty of this setup?

You don't need separate GL accounts for each customer or vendor. Instead, all transactions funnel through these reconciliation accounts, keeping your chart of accounts clean and manageable.

As one of my clients once said, "It's like having one mailbox for all your bills rather than a separate one for each company you deal with."

How Reconciliation Accounts Actually Work in the Real World

Here's where the rubber meets the road. Let's say you record a sale to a customer in your SAP system:

1. You enter the invoice in the customer subledger

2. SAP automatically creates a corresponding entry in your reconciliation account

3. Your financial statements reflect this transaction without any manual intervention

I remember troubleshooting a reconciliation issue at a manufacturing client where the accounts weren't balancing.

The problem?

They had been manually posting to reconciliation accounts (a big no-no) instead of letting the system handle it automatically.

Types of Reconciliation Accounts You'll Encounter

Through my implementation projects, I've worked with various reconciliation account types:

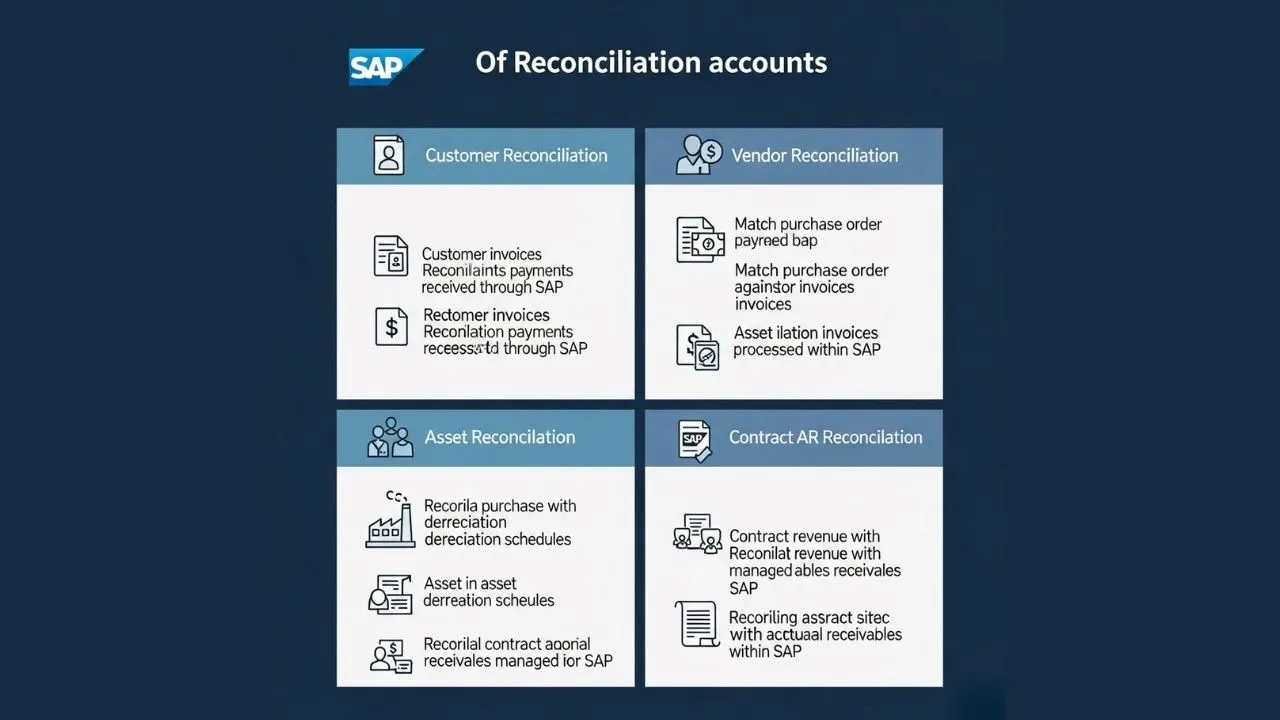

1. Customer Reconciliation Accounts: These track money owed to your company. For a retail client of mine, we set up separate reconciliation accounts for online versus in-store customers to better track revenue streams.

2. Vendor Reconciliation Accounts: For tracking what you owe suppliers. One manufacturing client needed separate domestic and international vendor reconciliation accounts for currency management.

3. Asset Reconciliation Accounts: These monitor your fixed assets. A healthcare client used these to track medical equipment depreciation separately from their facility assets.

4. Contract Accounts Receivable: For managing contract-based income. Particularly useful for my subscription-based software clients.

Setting Up Reconciliation Accounts Without Losing Your Mind

I won't sugarcoat it – setting up reconciliation accounts can be tricky. Here's my tried-and-true approach:

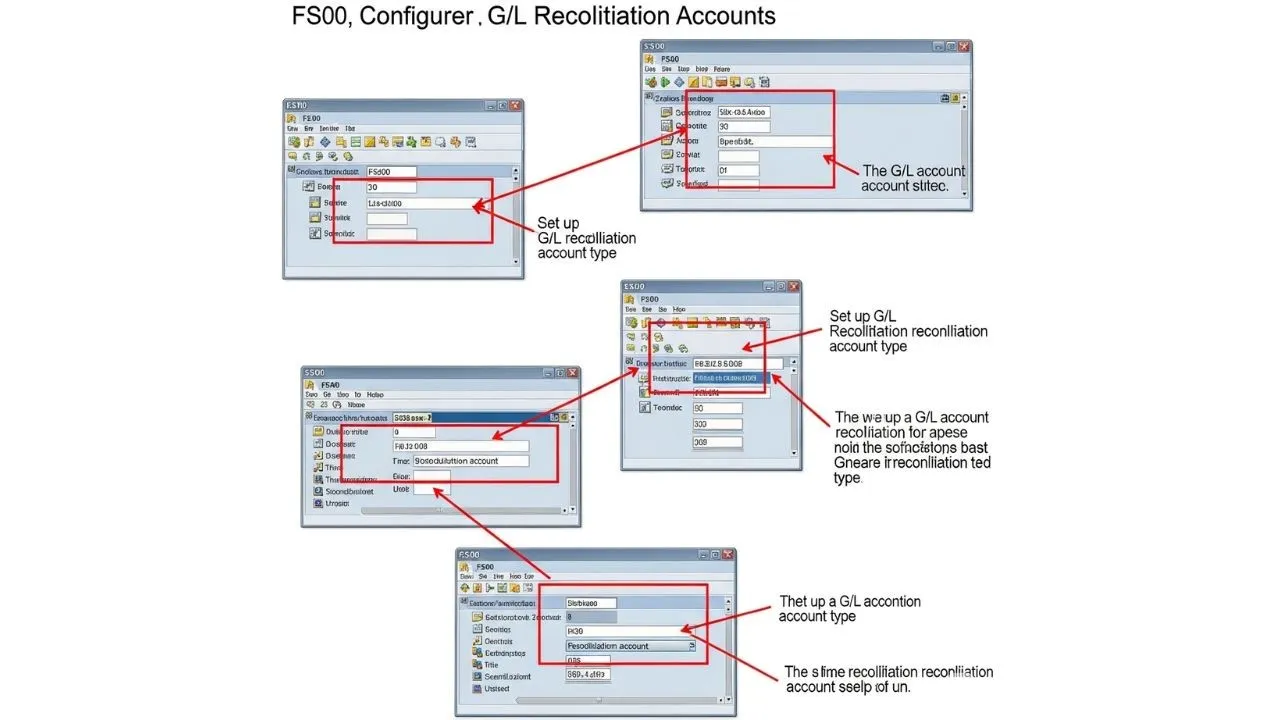

- 1. Use Transaction FS00 (or navigate through the SAP menu to Accounting > Financial Accounting > General Ledger > Master Records > G/L Accounts > Individual Processing > Centrally)

- 2. On the Type/Description tab, set the account as a Balance Sheet Account under G/L Account Type

- 3. In the Control Data tab, specify what type of reconciliation account it'll be (Assets, Customer, Vendors, etc.)

The trickiest part I've found?

Making sure you're consistent in your approach across all company codes if you're operating in a multi-entity environment.

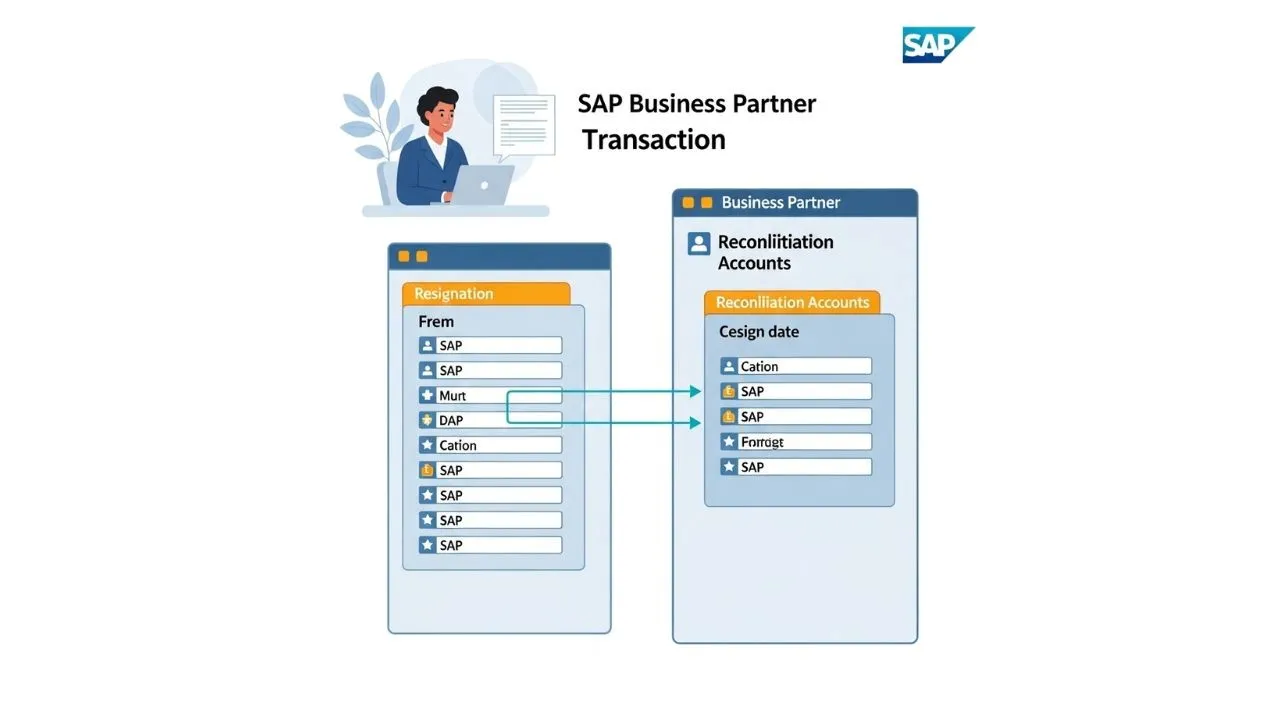

Connecting the Dots: Assigning Accounts to Business Partners

After creating your reconciliation accounts, you'll need to assign them to your business partners. This step often trips up new SAP users, but it's straightforward once you know the path:

- 1. Access your business partner via Transaction BP

- 2. Switch their role to FI Customer or FI Vendor as needed

- 3. Check the Company Code section to assign the right reconciliation account

A telecommunications client of mine streamlined this process by creating templates for different customer types, saving hours of manual assignment work.

Why You Should Care About Reconciliation Accounts

From my experience implementing SAP across various industries, proper reconciliation account setup provides:

- 1. Data you can actually trust: No more discrepancies between your subledgers and GL

- 2. Time savings during month-end: Reconciliation becomes less of a headache

- 3. Audit-ready financials: Auditors love the clear trail between detailed transactions and summary accounts

- 4. Real-time financial visibility: Get accurate snapshots of your financial position anytime

Real-World Challenges I've Encountered

Even with proper setup, you might face challenges:

- 1. Configuration complexity: Getting it right the first time isn't easy

- 2. Master data maintenance: You need processes to ensure new business partners get proper assignments

- 3. Special transaction handling: Some transactions need custom treatment

At one retail client, we discovered reconciliation issues during their year-end close.

The culprit?

Special promotional transactions weren't properly configured to post to the correct reconciliation accounts.

My Top Tips for Mastering Reconciliation Accounts

After dozens of implementations, here's what I recommend:

- 1. Don't skip the reconciliation: Regularly verify that your subledger balances match your reconciliation accounts

- 2. Document your approach: Create clear guidelines for your team

- 3. Use naming conventions that make sense: Your future self will thank you

- 4. Review periodically: Business needs change, and your account structure should evolve too

Wrapping Up

Reconciliation accounts might seem like just another technical SAP concept, but they're fundamental to maintaining financial accuracy.

Whether you're implementing SAP for the first time or looking to optimize your current setup, giving proper attention to reconciliation accounts will pay dividends in cleaner financials and smoother period-end closes.

Need expert help with your SAP financials?

At one retail client, we discovered reconciliation issues during their year-end close.

The culprit?

Special promotional transactions weren't properly configured to post to the correct reconciliation accounts.

Seller Rocket's team of SAP finance specialists can optimize your reconciliation account structure and streamline your financial processes. Reach out today to transform your SAP financial management.

Learn More : Amazon Global Selling from India | Seller Rocket